The review of the pairs EURUSD, GBPUSD, USDJPY on June 17, 2020, on the Forex

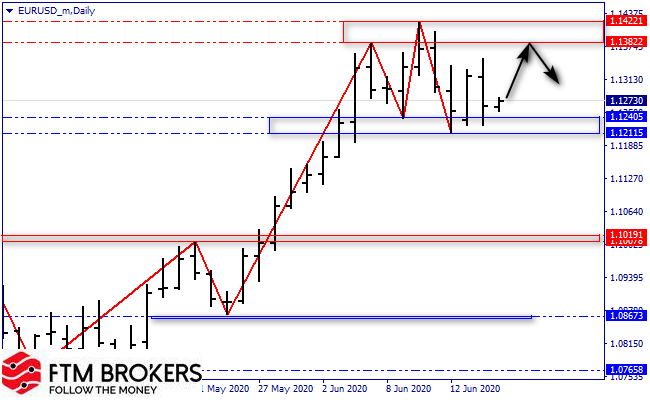

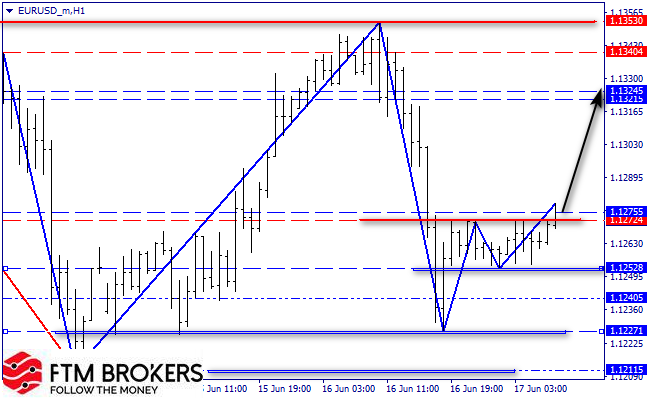

EURUSD

The daily chart: upward swing was not completed, plus the entry into the sales area was not tested as part of the O&U bear pattern (1.1383). Thus, the probability of a price return to this area will remain.

Н1: the local structure also has the upward trend signs – the peak is broken in zone 1.1272, and the market is now in a trend stage. Thus, the moving up probability in the 1.1324 and 1.1352 direction is very high.

The conclusions: growth in the 1.1324 and 1.1352 direction.

Investment solutions: the purchases to 1.1324 and 1.1352.

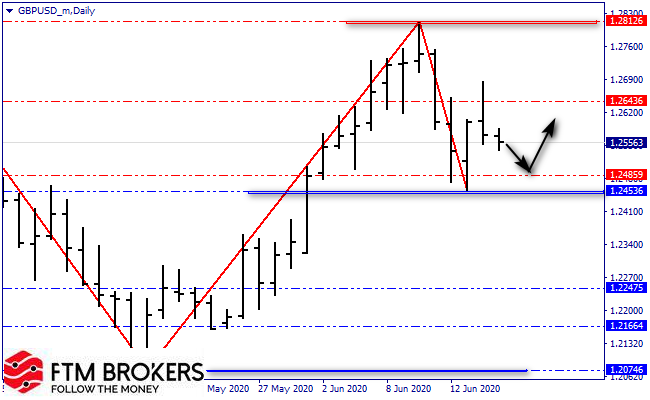

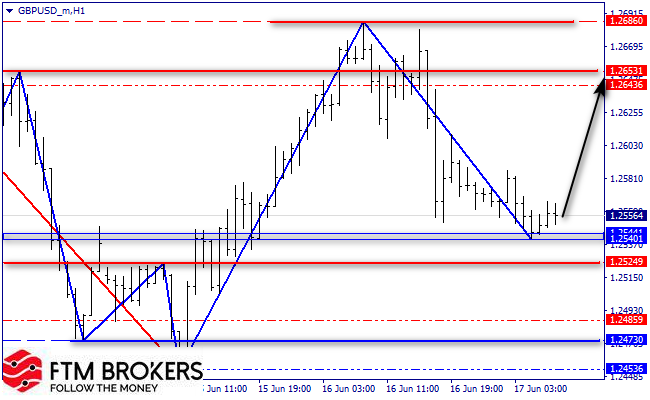

GBPUSD

The daily chart: the reverse bear bar does not open any special prospects for sellers, as the structure does not have a full upward swing. Thus, after a slight decline in quotes, we can again expect growth in the 1.2643 direction.

Н1: the local structure has a complete correctional downward swing; therefore, from the current levels, the British pound may rise in the last extremum (1.2686) direction.

The conclusions: the growth in the 1.2686 direction.

Investment decisions: the purchases to 1.2686.

USDJPY

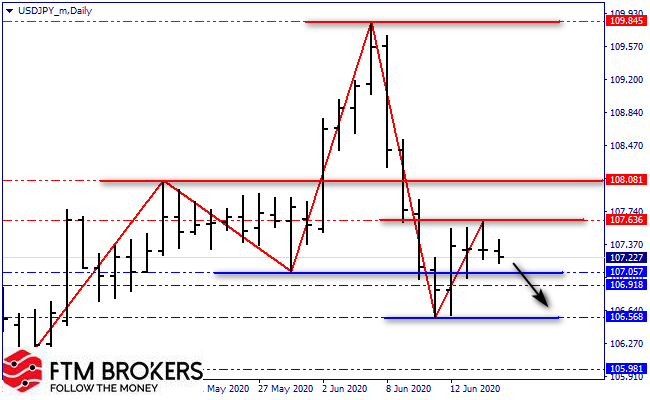

The daily chart: a bearish pin bar is formed at the upward swing end – a strong signal to decline. Thus, from the current levels, we can consider sales transactions in the 106.568 direction, where the nearest structure bottom is located.

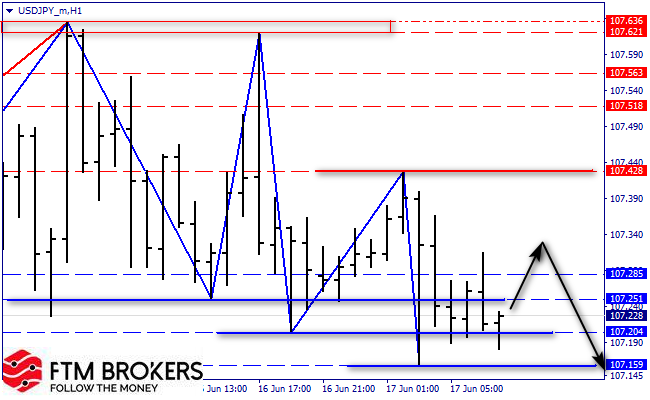

Н1: a local descending structure is in a corrective upward swing forming process, after which again we can expect a decline in quotations to new lows. The optimal sales area for the day is 107.285-107.340.

The conclusions: a rollback to 107.285-107.340 and then a decline in the107.000 and 106.568 direction.

Investment solutions: the sales from the zone 107.285-107.340 to 107.000 and 106.658.

Invest in the Forex market in Belarus with FTM Brokers!