The review of the pairs EURUSD, GBPUSD, USDJPY on June 19, 2020, on the Forex

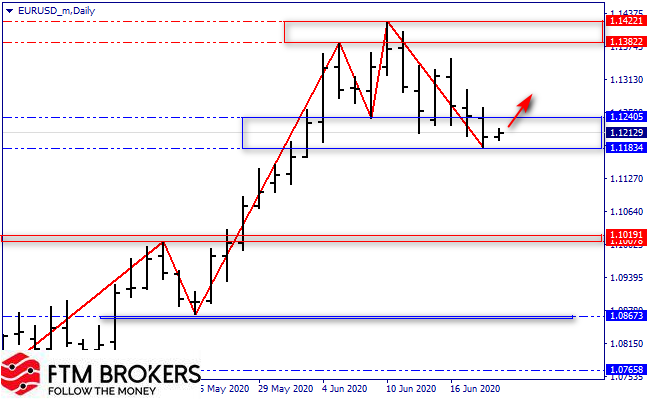

EURUSD

The daily chart: a downward swing tested the 11th figure, closing below the previous session. This preserves the bears’ chances to continue pressure, but at any moment a turn up is possible. The reasons are the wide pivot zone 1.1183-1.1240, plus the need to “go” to the proposal area 1.1382 as the part of the O&U pattern development.

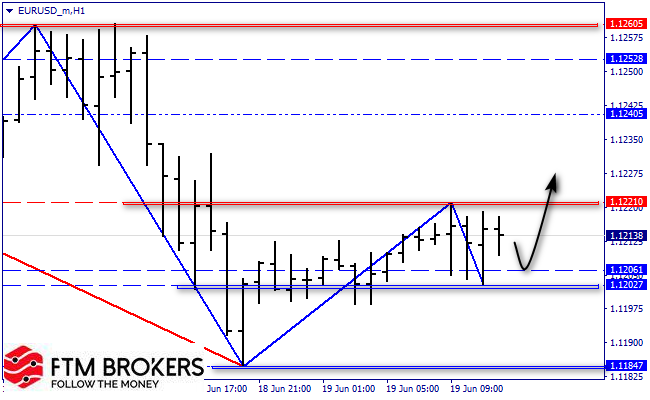

Н1: the local structure has turn-up signs – the bottom has been raised significantly, and the last downward swing has shown the sellers complete weakness. The control resistance is 1.1221. Once it is pierced, the U-turn will be fully confirmed.

The conclusions: growth above 1.1221 in the 1.1240, 1.1260 direction.

Investment decisions: purchases to 1.1240 and 1.1260.

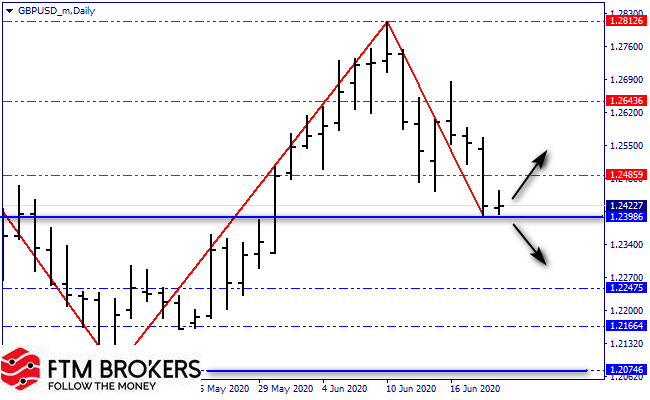

GBPUSD

The daily chart: the downward swing has significantly updated the lows, which, on the one hand, indicates a possible the downward correction continuation, but, on the other hand, in the 1.2400 round level zone the bulls may be activated. Thus, we have the possible scenarios duality.

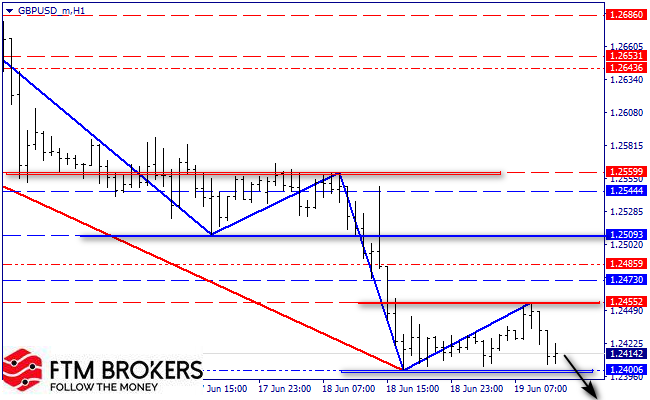

Н1: the local structure is still bearish without any questions. Moreover, it is in a trending stage. Thus, a 1.2400 support breakdown is possible and a further fall.

The conclusions:

The main scenario is a decline to 1.2350 and 1.2300.

An alternative scenario – in a rebound case from 1.2400, the pair will recover to 1.2455.

Investment solutions:

- Below 1.2400 – sales to 1.2350 and 1.2300

- Above 1.2400 – purchases to 1.2455.

USDJPY

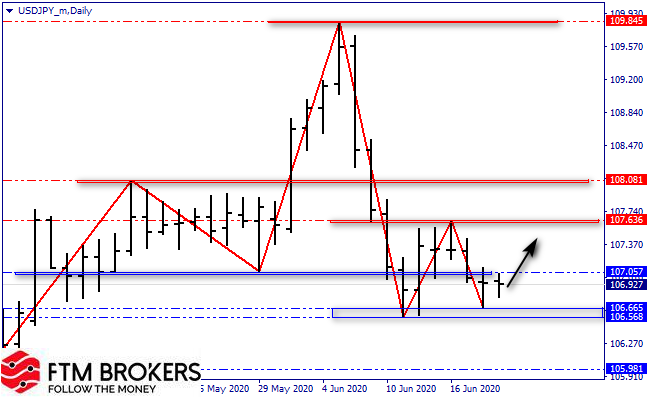

The daily chart: a pin bar at a downward swing end is a bullish swing possible start important signal in the last peak (107.636) direction. Moreover, the bears were not able to update the minimum structure yesterday, which may indicate weakness.

Н1: the local structure is still downward, but does not yet have a full upward swing. Thus, against the daily signal possible development background, a downtrend may break and growth above the nearest peak (107.122).

The conclusions: growth to 107.122 and 107.428.

Investment solutions: purchases to 107.428.

Invest in the Forex market in Belarus with FTM Brokers!